TL;DR: While decentralized lending has grown immensely in the past two years, we are still early in the evolution of DeFi towards the general extension of credit. We explore the three major categories of on-chain credit: overcollateralized, prime brokerage, and identity-based.

Since the massive explosion of DeFi activity and innovation in mid-2020, decentralized lending has become a core pillar of the emerging on-chain financial system. Driven by protocols such as Aave and Compound, which enable borrowers to deposit collateral in one token and withdraw part of its value in another, DeFi offers a near-frictionless token FX market and highly flexible trading exposure. However, because most current lending models require overcollateralized debt positions, on-chain borrowers generally lack access to general-purpose credit - that is, undercollateralized and unrestricted loans.

While the status quo has been extremely effective for trading and exposure to tokenized assets, we believe that the long-term potential of DeFi lies in establishing a truly independent alternative financial system. The infrastructure for this parallel system must be capable of serving the full range of traditional financial needs, and towards that end, we see undercollateralized lending models as an indispensable growth driver. In this piece, we will first assess the limits of overcollateralized lending, attempting to delineate what types of financial activity are possible within this paradigm. We will then examine the two primary alternative models for undercollateralized lending: decentralized prime brokerage and on-chain identity.

Because on-chain entities are untrusted by default, each lending model takes a different approach to re-establishing trust while mitigating credit risk. In the prime brokerage model, a protocol provides credit via a contract or proxy wallet that retains ultimate control over the use of funds. In the identity-based model, a protocol establishes some mapping from on-chain borrowers to distinct real-world entities before extending loans. Both systems exist today, but have seen limited adoption to date in comparison to the meteoric growth of overcollateralized lending. We believe that undercollateralized lending will see increasing adoption as markets mature, and that the two approaches represent complementary visions that can jointly accelerate the growth of on-chain credit.

Credit as the Engine of Growth

Before we delve into alternative approaches to the extension of credit, we need to pin down what “credit” means, what forms it takes, and why it matters. In practice, “credit” in DeFi typically means something quite different from what it does in traditional finance.

What is Credit?

In the real world, when we say “credit”, what we generally mean is access to money you do not have. Besides the interest rate, there are two main variables that determine the nature of the loan: what the borrowed funds can be used for, and how the loan is secured. In the case of a mortgage, a homebuyer might provide 20% of the purchase price as a down payment and receive the other 80% from the bank, for a 4:1 debt-to-equity ratio. That loan is secured, or collateralized, by a claim on the house itself. If the buyer stops making payments, the bank will repossess the house to recoup the value of the loan. Other loans are secured not with direct collateral, but instead with a senior claim on assets or future income. Credit card purchases and corporate bonds are very different in duration and scale, but in both cases, the lender has recourse to the borrower’s other assets that partially compensates for the lack of collateral. In case of nonpayment, outstanding claims will eventually be resolved via a collections (individual) or bankruptcy (corporate) process.

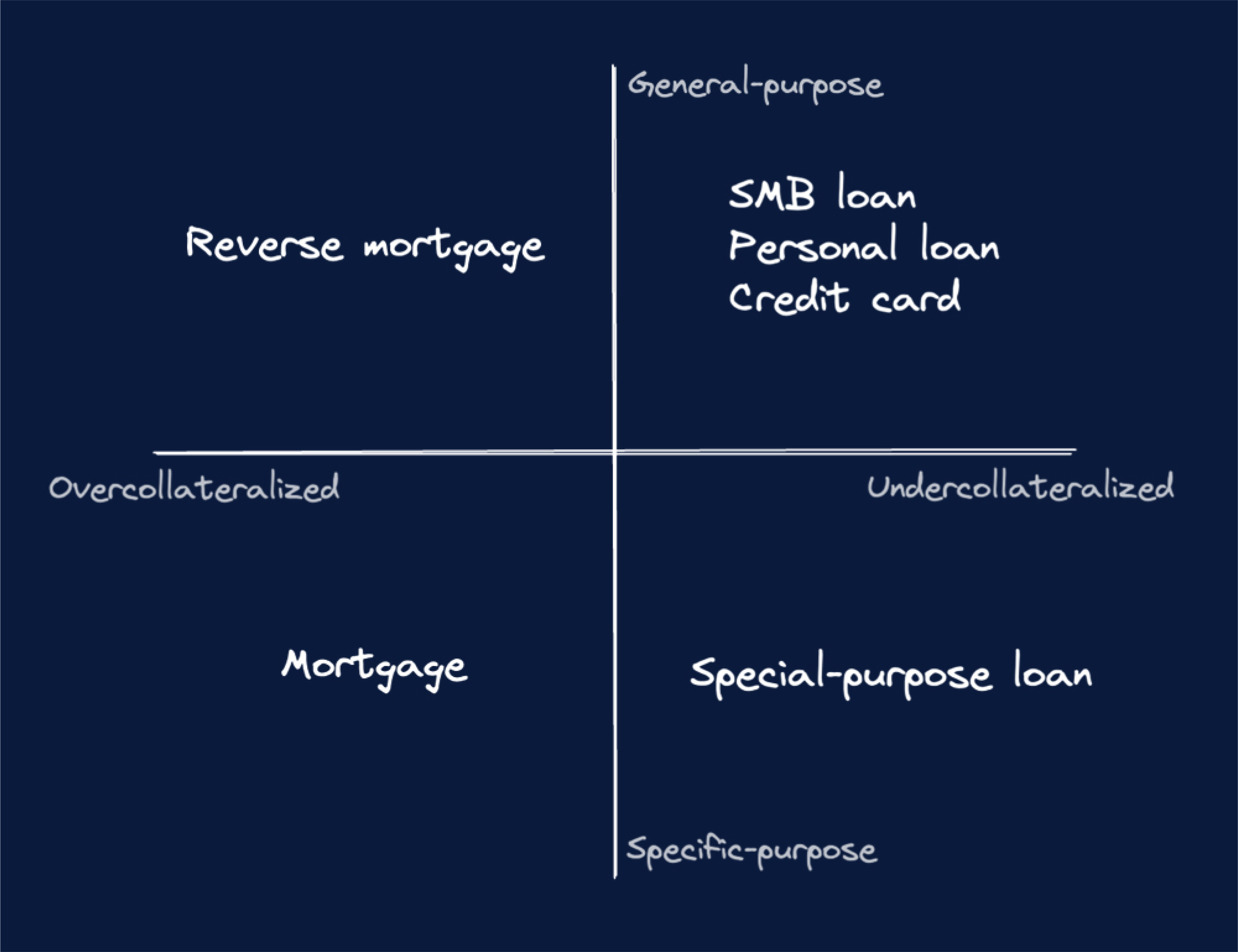

Both directly and indirectly collateralized lending are critical to the operation of the modern economy, as they provide the capital that powers consumption and investment. Consider every loan as occupying some point on the spectrum from overcollateralized to undercollateralized, and another on the spectrum from specific-purpose to general-purpose, and it becomes clear that traditional finance supports all quadrants. (In most cases the primary variable is collateral, with specific-purpose overcollateralized loans and general-purpose undercollateralized loans, but we will use two axes for greater precision.)

In the world of DeFi, the “credit” offered by decentralized lending protocols generally means something quite different: rather than access to more money, the primary use case is exposure to a different asset mix. Common applications include carry trades, i.e. lending at a higher rate and borrowing at a lower one, and shifting portfolio composition without incurring taxable events. Of course, these are also possible in traditional finance, but they are not the aims of the typical borrower.

We all know DeFi can handle overcollateralized lending via protocols such as Aave. What about the other quadrants? It turns out we can accomplish a great deal in terms of magnifying exposure on the trading side. Various protocols for margin trading and perpetuals (dYdX), leveraged tokens (Tokensets), and exotic options (Opyn) enable DeFi users to trade with leverage and target specific risk-reward profiles. As we will see shortly, we can also use overcollateralized lending protocols to simulate levered asset purchases such as mortgages. However, none of these methods ultimately provides general, undercollateralized access to credit. To distinguish more concretely: if I obtain a personal loan for $50,000 despite having only $10,000 in the bank, I can use it to buy stocks, purchase a car, or bury it under the mattress, with the lender none the wiser. With overcollateralized lending protocols, this is simply not possible. Using our previous axes, we see the gap appearing in the upper right:

Making Undercollateralized Lending Overcollateralized Again

Before looking at the alternatives, let’s squeeze all we can out of overcollateralized lending. The basic invariant of any overcollateralized protocol, of course, is that if you deposit X you cannot withdraw more than X. However, there are two ways of turning X into a position worth more than X: recursive deposits and flash loans.

The conceptually simpler method is recursive depositing, or the re-use of debt as additional collateral. It turns out that we can obtain leverage this way whenever we can swap from the borrowed token to the collateral token. When this is possible, we can simply deposit collateral in one token, borrow against it in another, swap the debt to the collateral token, redeposit, and repeat. (Note that this is similar to “rehypothecation”, in which the same collateral is pledged for two or more unrestricted loans, but this can lead to a scenario where two or more lenders attempt to seize the same collateral. With recursive deposits, this cannot happen even if the entire position is liquidated.)

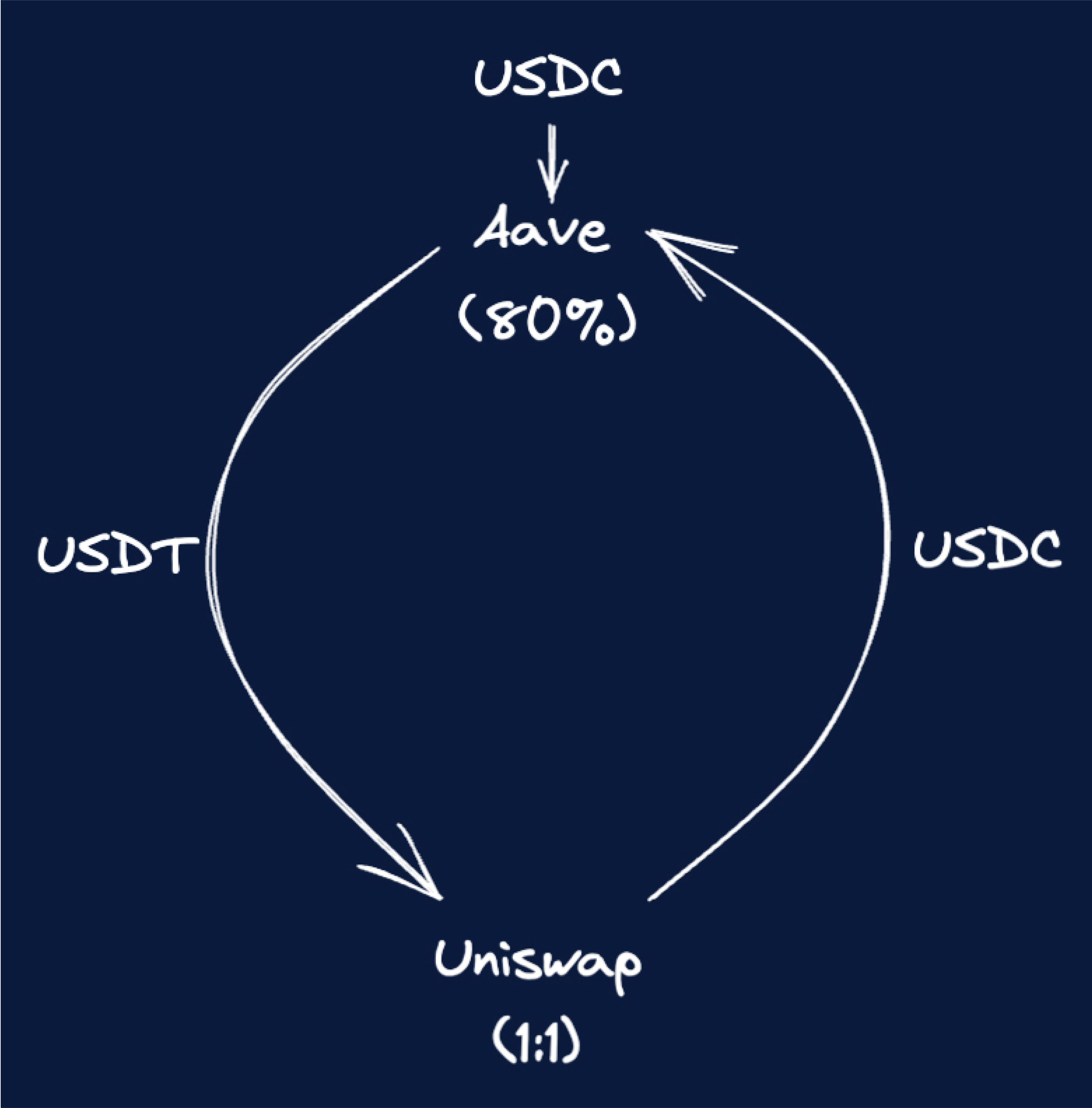

Consider a scenario in which USDC pays a higher interest rate than USDT, and a yield trader wants to collect the spread via a long position in USDC offset by a short one in USDT. If Aave accepts USDC with a maximum collateral ratio of 80%, the trader can combine Aave with Uniswap to create a “leverage loop”:

The resulting position would be collateral in USDC offset by debt in USDT, allowing our trader to collect the spread on the levered position. How much leverage can they get? Ignoring fees and slippage, a collateral ratio of r can support leverage of up to 1/(1 − r) (Appendix B). For instance, with $1M worth of starting equity and an 80% collateral ratio, our trader could obtain long exposure of $5M - that is, Aave would show $5M lent against $4M borrowed.

While the recursive-deposit method has a certain aesthetic appeal, transaction costs and slippage limit its utility in practice. Flash loans, which must be repaid within a single transaction but can provide arbitrary amounts of temporary capital, offer a more elegant solution. We can obtain the same leverage as above by flash-loaning Cr/(1 − r) to an address holding C, depositing all funds as collateral, and borrowing Cr/(1 − r) to repay the flash loan. We then have a debt position of Cr/(1 − r) against collateral of C/(1 − r), providing a leverage ratio of 1/(1 − r). Again, this method creates a $5M long position against a $4M short using only $1M in starting equity.

In fact, flash loans don’t just increase capital efficiency - they also fundamentally expand the design space of overcollateralized lending. Specifically, they enable us to buy not only tokens, but also non-divisible assets as represented by NFTs. Anything that can be tokenized and used as collateral, whether Bored Apes or tokenized real estate, can be "mortgaged" this way (Appendix C). Indeed, if it were legal and enforceable, an anonymous borrower could use this method to buy a house on-chain! This would not work via recursive deposits, because there is no way to buy 20% of an NFT, but flash loans allow us to complete the entire process in one step.

Limits to Overcollateralized Lending

As clever as the flash-loan mortgage is, there are still two issues that seriously limit its usefulness as a form of credit:

- Can’t use it. Generally speaking, the point of getting a mortgage for a house is to live in the house while you pay off the mortgage. In the above examples, the collateral is stuck in an Aave contract, making it unavailable for use anywhere else. This issue would be even worse for the Bored Ape because the “owner” would be unable to sign transactions, making the Ape useless for, say, attending an NFT-gated yacht party.

- Might lose it. If the Bored Ape floor price falls enough, the Ape used as collateral could be liquidated. NFT floor prices are notoriously volatile, so there would be a significant danger of realizing this outcome. This is not a problem with a traditional mortgage - the bank cannot seize your house when its value drops if the mortgage itself remains in good standing.

More generally, while recursive deposits and flash loans are excellent solutions for margin trading, they are much less effective for asset purchases. In the trading case, the borrower is generally indifferent between exposure and ownership; ignoring taxes and fees, an index fund or total-return swap is just as good as the underlying assets themselves. For purchases such as a house or an NFT, the borrower cares deeply about having full ownership and use of the asset itself, not an economic proxy. It may be possible to re-establish some of the benefits of ownership - imagine Aave with a “restricted-transfer wallet” to hold the collateral, essentially MetaMask with a minimum-value invariant - but even this would fall short of full ownership.

Exposure vs. ownership is also a key concern when assessing volatility. For traders, volatility is an unavoidable component of a healthy, functioning market, and the risk of liquidation is both accepted and anticipated. For buyers, the prospect of “liquidation” in the sense of losing ownership is generally unacceptable, regardless of expected financial returns.

Why Do Undercollateralized Loans Matter?

Given the issues above, we might ask why “mortgages” (specific-purpose loans collateralized by the purchased asset) belong on-chain at all, let alone general-purpose credit. Why not keep underwriting in the real world?

We contend that if DeFi’s true potential lies in the establishment of an independent financial infrastructure, then it must eventually replicate all the major functions of that infrastructure. Among those functions, general-purpose credit is arguably closest to the raison d’etre of modern finance: to align, in both form and function, capital supply and demand. Put another way, the financial system exists to drive investment and growth by creating liquidity.

From a borrower’s perspective, overcollateralized lending removes liquidity because it decreases the assets available for general use. That is, for every deposit X that is locked in the platform, at most Xr, where r is the maximum collateral ratio, can be borrowed for general use elsewhere. (This is true even though lending makes capital more productive [Appendix D].) In order to create growth in the decentralized economy, we must find ways to make r greater than 1: that is, to give borrowers access to more money than they currently have.

Crucially, it is liquidity and not merely leverage that drives economic growth. Consider a renewable energy company whose products can dramatically increase the amount of available energy worldwide (which would also increase global GDP), but only with a large up-front investment. Such a company might take 20 years to generate the necessary funding from internal profits alone, whereas a mature corporate debt market can provide instant access. No overcollateralized lending protocol can underwrite this venture, because the projected income streams securing the loan don’t exist yet. For DeFi to serve as a truly parallel financial system, we need mechanisms that can power exchange, consumption, and investment.

Sybil Borrowing and the Incentive to Default

Ideally, an honest borrower could build on-chain credit for an address just as they would in the real world, demonstrating creditworthiness through repeated good behavior. However, the naïve approach runs afoul of a basic economic constraint: the incentive to default. Real-world penalties for neglecting one’s debts tend to be sufficiently harsh that few consider defaulting voluntarily. We are a long way from the days of debtor’s prisons, but the prospect of a ruined FICO score, along with the increased borrowing rates and denials of credit that would follow, is an effective motivator. And the American system is far from the harshest option - someone whose ability to ride a train depended on their social credit score would never dream of voluntarily ruining their credit.

In crypto, this reasoning does not apply because there are no FICO scores: not for lack of trying, but because the concept of a credit score presumes a well-defined entity to which that score is assigned. Again, this is simple in the real world: the borrowing entity corresponds to a known person or corporation, and in case of problems can be traced back to a mailing address, a tax ID (SSN or EIN), and a phone number. In the blockchain universe, the typical “borrower” is a stubbornly uninformative hexadecimal address. It may be labeled on Nansen (perhaps erroneously), but there is no guarantee of an identifiable individual behind the address, let alone the possibility of recourse in case of default. The address may be one of many belonging to an individual, or part of a protocol treasury, or a bot. This versatility is, of course, the point: it enables DeFi protocols to operate with the permissionlessness, composability, self-sovereign identity, and other qualities that make them desirable in the first place. But what happens when address 0x1337 stops making interest payments?

This fragmentation of identity incentivizes what we call Sybil borrowing: taking out loans on behalf of anonymous or disposable entities, then defaulting without broader impact on creditworthiness. Before globalization and modern record-keeping, Sybil borrowers were also common enough in the real world. It was quite possible in 18th-century Europe to accrue unpaid debts in England, flee to France, and begin again under a new name. (Some were even more brazen.) Even so, this kind of evasion would have entailed considerable difficulty and personal sacrifice. On-chain, especially with the help of Tornado or a fake account on a centralized exchange, anonymously creating and funding a new address could be as simple as a few clicks.

Because of Sybil borrowing, an undercollateralized lending protocol that attempted to prevent defaults by means of consequences for individual addresses would be quickly drained by fraudulent borrowers. Admittedly, it might be possible to reward longevity or good behavior in a way that anonymous participants would still be incentivized to safeguard the reputation of their accounts, much as trading platforms reward high-volume participants with lower fees. However, we expect that the majority of anonymous borrowers would not possess this level of reputational capital. The median borrower would have every reason to treat the protocol as an opponent in an iterated prisoner’s dilemma, “cooperating” via good behavior until the value of outstanding loans grew large enough to “defect” and abscond with the funds. This is why a protocol that aims to provide general-purpose loans must tackle the issue of identity in addition to that of credit risk.

Each of the three lending models employs a different mechanism to ward off the Sybil borrower. With overcollateralization, the incentive is economic. In decentralized prime brokerage, it is algorithmic and technical. With on-chain identity, it is social and legal. All three mechanisms make for viable decentralized lending markets, but each requires a different kind of sacrifice and pins success on a different type of market participant.

Safety through Overcollateralization

The first response to the Sybil question, which boils down to “why shouldn’t I take the money and run?”, is to use financial incentives as a form of economic security: you won’t default, because you’ll lose money. This is the promise maintained by every fully collateralized debt position: given the choice between giving up the collateral or the loan, the borrower prefers to preserve access to the collateral because it has greater value. The overcollateralization invariant - ensuring the collateral is always more valuable than the loan - is maintained by liquidation auctions, where participants are rewarded for buying out a debt position whenever its loan-to-value rises enough that it is in danger of becoming undercollateralized.

Most activity in protocols such as Aave and Compound is single-layered, depositing and borrowing only once, though there are ways to achieve levered exposure as previously discussed. Some protocols, such as DeFi Saver, create an automated execution (recursive deposit) layer atop these lending protocols, while others such as Alpaca offer platform-native leverage. However, because total debt never exceeds total collateral, all borrower positions remain overcollateralized even when nominal exposure is multiplied, ensuring the solvency of the protocol as a whole.

Establishing Closed Systems with Prime Brokerage

A second solution to the Sybil question is to keep the reliance on “code is law” but flip the constraints: rather than enforcing overcollateralization in an open system, simulate undercollateralization in a closed system by restricting the use of funds. By creating a large but well-defined boundary via an interface or set of integrations, a protocol can deliver the benefits of undercollateralized lending while remaining technically overcollateralized by retaining ultimate control of the assets (Appendix A). We can think of this sort of “borrowing in a bubble” as algorithmic security: you can’t default, because the code won’t let you.

Financial action at a distance is a characteristic feature of traditional prime brokers, hence the label “decentralized prime brokerage” for this model. However, the general concept of “prime brokerage” is much broader than banks providing execution for hedge funds. The actual operations involved - providing leverage, market access, and other benefits while making trades and executing transactions on behalf of clients - also occur every time a customer interacts with a centralized exchange such as Binance, FTX, or Coinbase. For these exchanges, the “boundary” of the system is defined by the exchange’s own partnerships and enforced by a combination of technological controls and manual review.

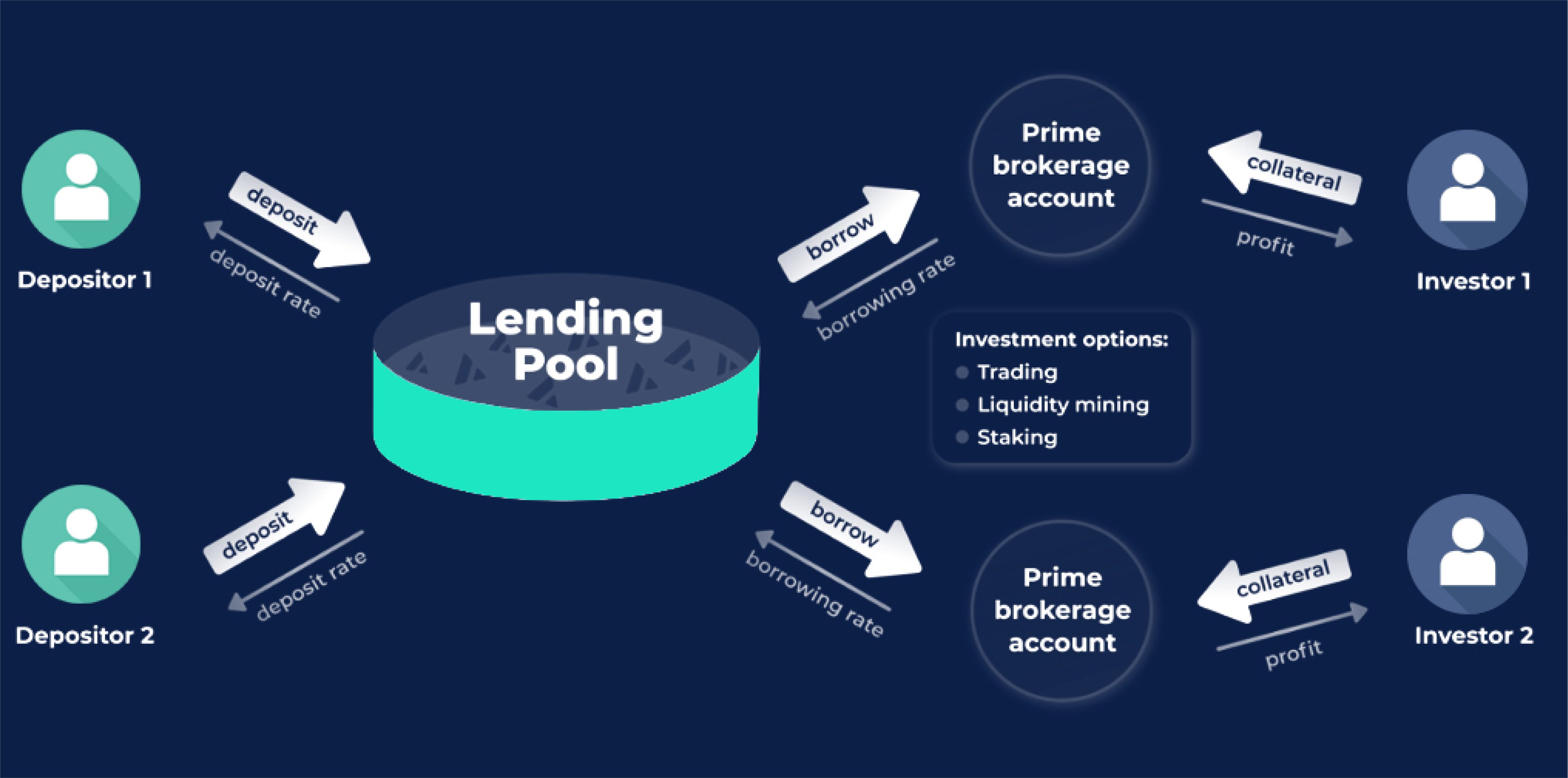

Decentralized prime brokerage is the result of defining boundaries and executing transactions on-chain. A decentralized prime brokerage protocol can implement the necessary restrictions via several types of access control, such as:

- Issuing funds to a restricted wallet, which allows a well-defined set of commands and smart contract interactions

- Issuing funds to a proxy contract, which allows deposits from any wallet but only implements a specific set of functions

- Denominating funds in a restricted token, which is only transferable between protocols that have a pre-specified interface with the lender (we have not seen this approach, but a modified ERC20 could theoretically function this way)

Restrictions may be specific, such as a whitelist of allowed function calls per smart contract, or general, such as a minimum-value invariant for the address holding the debt. Whatever the method, the key is to ensure that the loan (a) can be put to good use, but (b) cannot be transformed into a freely tradable token in an unrestricted, self-custodial wallet.

Oxygen is one example of a decentralized prime brokerage, and others, such as DeltaPrime, are rapidly building out new solutions. Credit accounts by Gearbox are another variation on this model, though leverage is currently limited to farming and liquidity provision. However, the cumulative volume among all decentralized prime brokerage protocols remains orders of magnitude below that of overcollateralized lending.

In the long term, we would expect decentralized prime brokerage solutions to exhibit strong network effects, since the utility of borrowed capital depends on the number and quality of available integrations through each platform. Network effects tend to drive consolidation, so we would expect to see, if not winner-take-all, at most a few major players negotiating and integrating directly with each other. Of course, a protocol could also offer permissionless integration via a smart contract interface, but for key markets and complementary prime brokerage solutions, we would expect a more bespoke relationship driven by the protocol team.

Real-World Mapping with On-Chain Identity

Both the overcollateralized and prime brokerage approaches impose limitations on credit, restricting either the types of leverage obtainable (overcollateralized) or the available uses of capital (prime brokerage). In order to enable fully general-purpose loans, where borrowers truly can run off with the money, we need another incentive mechanism to ensure that the net losses from doing so outweigh the immediate gains. Ultimately, this requires imposing broader consequences for the borrower themselves, which we refer to as sociolegal security: you won’t default, because you will be punished off-chain.

Returning to our earlier FICO example, a borrower who defaults in the real world faces two types of consequences: the prospect of having their income or assets forcibly repurposed, and the impact on creditworthiness that will make future loans either much more expensive or impossible to obtain. Borrowers will generally cooperate as long as either of these conditions holds, and in either case, each loan must be traceable to a real-world entity on whom reputational and/or legal consequences can be imposed. That said, while there must be some party with enough information about the borrower to impose consequences, it need not be the lender. This is the idea behind performing a minimalist version of KYC (”know your customer”) via on-chain identity. As long as there is at least one participant able to attest to the borrower’s identity, thus supplying the incentive, and one willing to underwrite the loan, supplying the capital, there is no need to disclose the borrower’s identity to any parties besides the source of attestation.

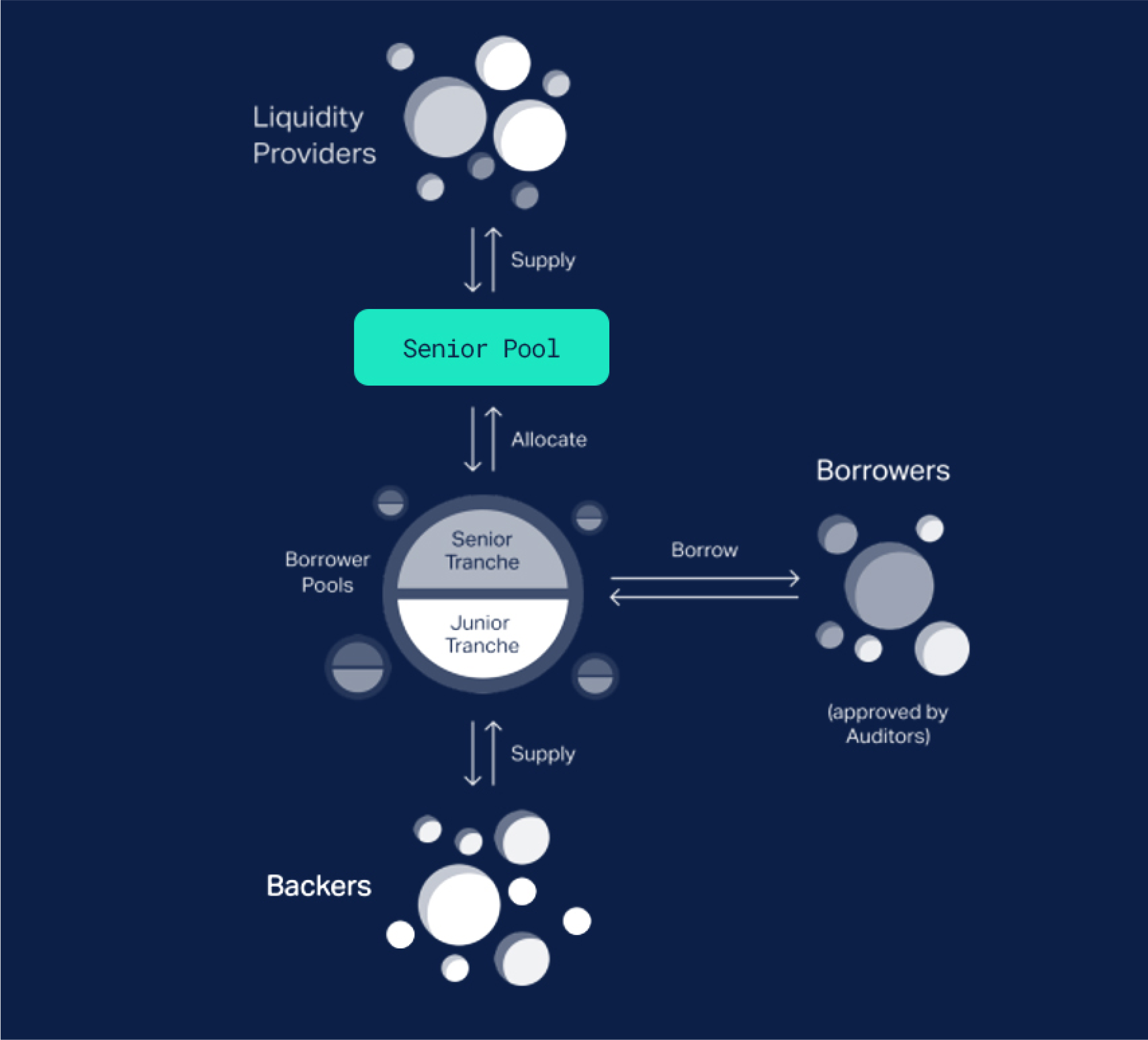

One of the more sophisticated identity-based approaches is Goldfinch, which aims to serve developing markets by bringing both underwriters and borrowers on-chain. Using a three-party model of backers, liquidity providers, and borrowers, Goldfinch segments risk between general LPs, who hold the senior tranche of each loan, and backers, who provide underwriting services and receive higher returns in exchange for taking the junior tranche. So far, the platform has extended over $100 million in loans. TrueFi is another take on this model, and at the time of writing has nearly $400 million borrowed. Like decentralized prime brokerage, identity-based lending is still a long way from reaching the 10- and 11-figure sums in overcollateralized lending, as shown in The Block’s recent overview. However, a longer growth curve is also to be expected for an intrinsically complex problem space with a broad range of stakeholders.

Comparing the Three Approaches

Having outlined the three major approaches to on-chain credit, we can compare their benefits and drawbacks along several axes.

Basic Properties

We will begin by summarizing the basics: what are the fundamental properties of each approach, and what types of lending activity do they support? We define our categories as follows:

Security guarantee: How does the lending mechanism prevent Sybil borrowing?

Effect on borrower liquidity: Does the borrower’s access to liquid capital increase or decrease?

Borrower identity: Who or what is ultimately responsible for repaying the loan?

Uses of credit: How broad is the range of uses for credit obtained?

Lending MechanismSecurity GuaranteeEffect on Borrower LiquidityBorrower IdentityUses of CreditOvercollateralizedEconomicMostly NegativeAddressGeneral-purposePrime BrokerageAlgorithmicPositiveAddressSpecific-purposeIdentity-BasedSociolegalPositiveEntityGeneral-purpose

As discussed earlier, overcollateralized lending generally decreases borrower liquidity, except (in a restricted sense) when amplified by loops or flash loans. Decentralized prime brokerage occupies a middle ground between overcollateralized and identity-based models, creating liquidity for both trading exposure and asset ownership, but only for services integrated with the protocol. Identity-based lending succeeds in unlocking true general-purpose credit, but in return requires a much stronger notion of identity.

Scalability Drivers

Looking at the system level, we can also evaluate each lending mechanism by looking at the key growth drivers for protocols that use it.

System complexity: How many “moving parts” are required to facilitate a single loan?

Network effects: How strongly does utility depend on the number and quality of participants?

Quality driver: What is the key aspect that governs the value of the service to the borrower?

Scales with: Which type of participant is most critical for building a strong ecosystem?

Lending MechanismSystem ComplexityNetwork EffectsQuality DriverScales WithOvercollateralizedLowLowDepth of lending poolInvestors (TVL)Prime BrokerageMidHighUses of capitalPartnershipsIdentity-BasedHighMidCost of capitalUnderwriters

The overcollateralized model wins handily on simplicity and low starting costs, which explains why overcollateralized lenders tend to follow DEXs as the first addition to every new blockchain ecosystem. Both identity-based and prime brokerage models require a bit more effort to overcome the cold-start problem due to their relatively strong network effects. However, the two types of networks rely on different core growth drivers: a decentralized prime brokerage expands by adding integrations and partnerships, while an identity-based system scales with its underwriters. Since these network effects drive improved costs of capital for identity-based systems and broader uses of capital for prime brokerage systems, we see the network effects on the prime brokerage side as more fundamental.

The Crypto Ethos and the Credit Trilemma

Finally, we will compare the three approaches on a philosophical basis, looking at how well they adhere to various aspects of the crypto ethos:

Decentralization: To what extent can the system be controlled by a few dominant parties?

Composability: How easy is it to integrate the service with other protocols?

Permissionlessness: How reliant is the system on gatekeeping or third-party authorities?

Sovereignty: How much control does the borrower have over their identity?

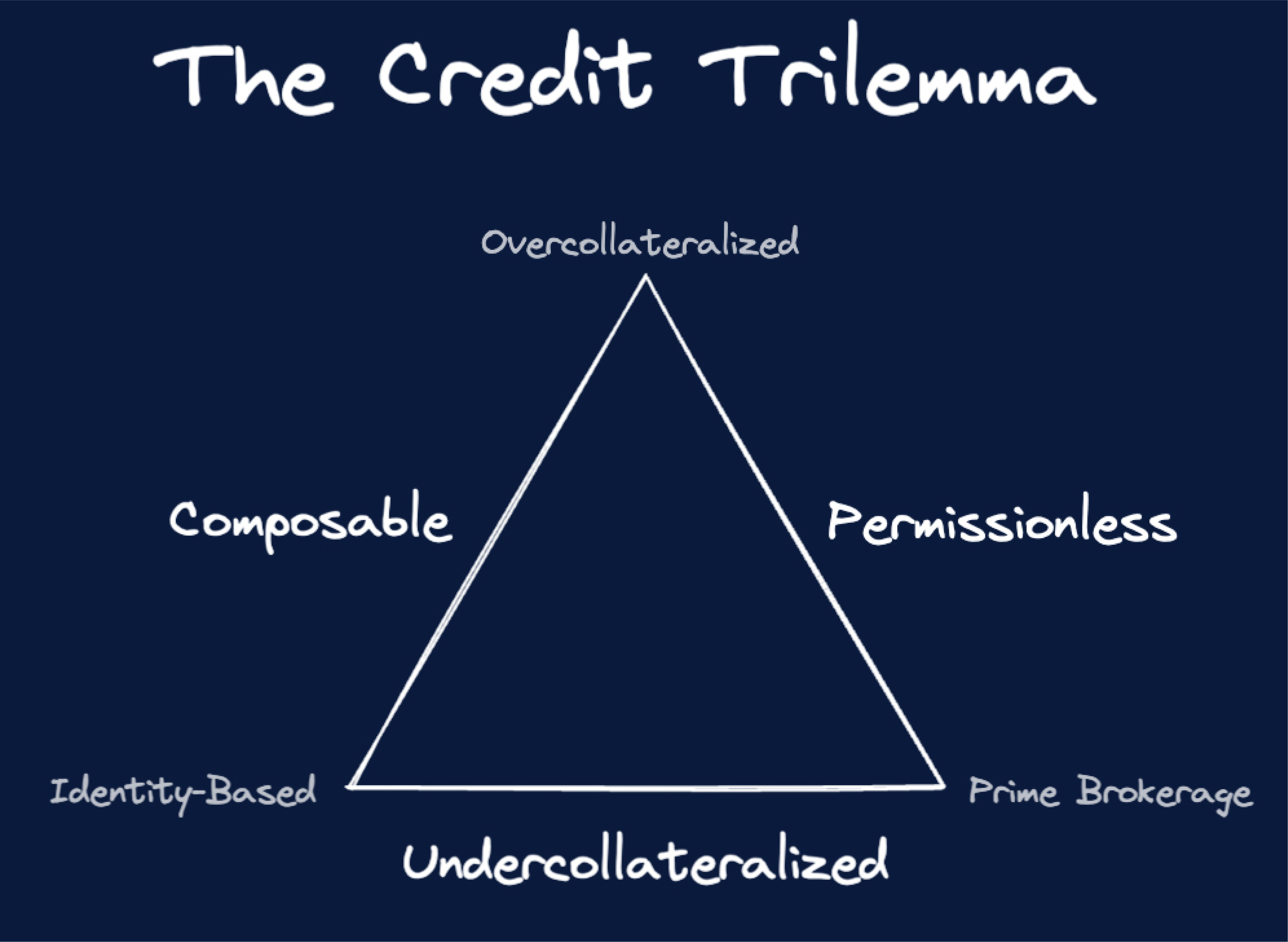

Lending MechanismDecentralizationComposabilityPermissionlessnessSelf-SovereigntyOvercollateralizedHighHighHighHighPrime BrokerageMid-LowLowHighHighIdentity-BasedHighHighLowMid-Low

Overcollateralized lending epitomizes the benefits of the on-chain approach: anybody can lend to, borrow from, or build atop the protocol, with no requirements (permissioned pools aside) for identifying information or third-party gatekeepers. Identity-based and prime brokerage lending each make sacrifices to enable a broader range of loans, but the tradeoffs come in different areas. Decentralized prime brokerage preserves permissionlessness and self-sovereignty, but at the cost of composability and some decentralization. Driving new use cases and partnerships will likely require the efforts of a centralized core team, and composability is limited because funds can only flow within the boundary defined by the protocol. In contrast, identity-based lending preserves composability thanks to general-purpose loans, but relinquishes permissionlessness because every loan requires the due diligence and approval of an off-chain gatekeeper. Self-sovereignty also suffers because borrowers must volunteer real-world information, even if only the final attestation or encrypted hash is ultimately published on-chain.

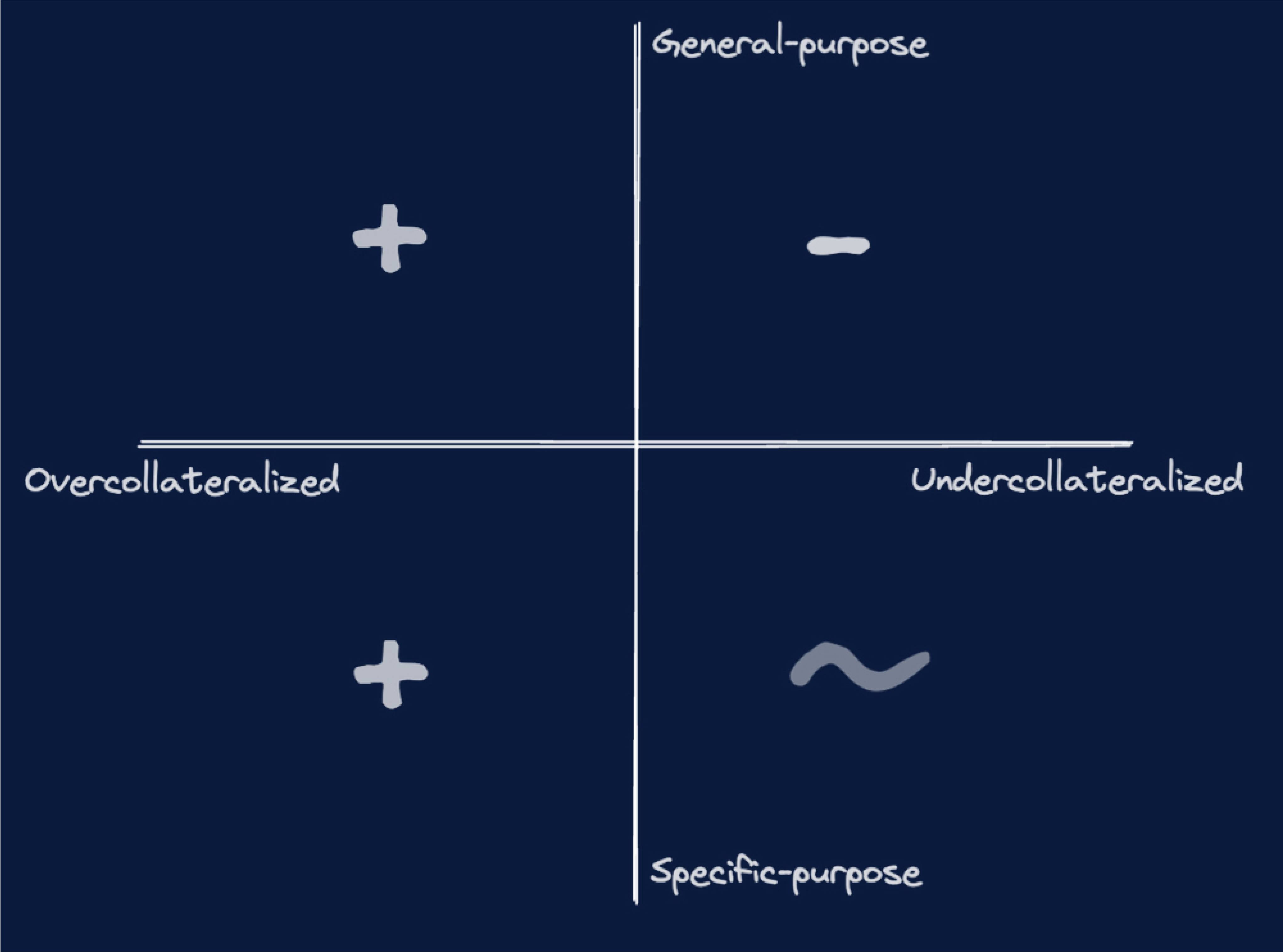

Tongue firmly in cheek, we can think of the tradeoffs in on-chain lending as yet another trilemma - the credit trilemma. On an ideal platform, loans would be composable, permissionless, and undercollateralized, but the basic form of each solution delivers on two fronts and struggles with the third:

Endgame: How Would the World Look?

Having addressed the benefits and drawbacks of each lending approach, we might also ask: is there one side that should win? How would on-chain credit look at scale in each paradigm?

We might expect a prime brokerage-driven credit market to look somewhat like an archipelago, with “islands” of services integrated with each protocol linked via mutual agreements between them. Each protocol would benefit from internal network effects as its total capital and range of uses increased, but also from inter-protocol “trade” enabled by reciprocal agreements to honor debt positions. This highly interconnected, execution-agnostic end state would be familiar to traditional finance veterans: when a hedge fund buys a stock, its clients neither know nor care whether Morgan Stanley or Goldman Sachs is ultimately making the purchase.

An identity-based credit market may instead tend towards reconstructing real-world relationships. Local underwriters would have better risk models for the demographics they knew best, and borrowers would be able obtain better rates from underwriters with better off-chain access to their identity and credit history. Even in a “decentralized” network with many independent members, these structural factors would remain to some extent. However, as lenders learned to export their risk models to similar borrowers in different markets, the importance of geography might wane. In the long term, a competitive on-chain marketplace with borderless lenders and semi-commoditized risk models could not only drive better terms and expand access to credit, but even serve as an equalizing force in real-world credit markets.

Though the two models scale quite differently, we see them as complementary, each tailored to a different core use case and borrower profile. Want to get an anonymous mortgage for a Bored Ape? Use a decentralized prime brokerage to obtain the loan, then send the BAYC to a proxy wallet that lets you sign for ownership. Need a 1-year personal loan? Shop rates using your real credit score - the rest of your identity is protected as long as the loan remains in good standing - and use the funds on-chain or send to your bank account via any fiat off-ramp.

Towards a Net-Positive Future

In this post, we examined the three lending mechanisms that make secure and decentralized credit markets possible: overcollateralization, decentralized prime brokerage, and on-chain identity. While the overcollateralized model has driven over $100 billion of lending activity and enormous innovation in protocol design, we believe that prime brokerage and identity-based models will be critical in order to enable the full range of economic use cases. DeFi already has excellent solutions for trading, FX, remittances, and “borderless” capital, but to drive lasting economic value will require more general models of on-chain credit. That means offering the full range of lending services, from overcollateralized and specific-purpose to undercollateralized and general-purpose. While the long-term equilibrium remains to be seen, we look forward to a world in which the three approaches complement each other, jointly supporting the creation of a thriving on-chain financial system.

Thanks to the research team at Jump Crypto and especially to Nihar Shah and Shanav Mehta, as well as Tina He (Station), for their input and feedback.

Appendix A: Defining “Undercollateralized”

The difference between overcollateralized and undercollateralized loans may seem obvious at first glance, but we need to be precise. For instance, how do we determine whether a mortgage loan is overcollateralized or undercollateralized? How about a margin trading position? The balance on a personal credit card?

First, let’s look at how Google defines collateral: “something pledged as security for repayment of a loan, to be forfeited in the event of a default.” In other words, collateral is whatever gets seized when the loan goes bad. The collateral for a mortgage is the house; the collateral for a margin trading position is the assets in the account (both cash and whatever was bought on margin).

A loan is overcollateralized when the total value of the collateral exceeds the value of the loan, so the lender will be made whole even if the borrower defaults. An undercollateralized loan is anything that does not meet this standard, either because no direct collateral is provided or because seizing and selling that collateral will fail to recover the full value of the loan.

Having clarified our definitions, we can say that a mortgage loan is usually overcollateralized, but may become undercollateralized if the value of the house falls below the remaining balance on the mortgage. Likewise, the margin trading position is overcollateralized as long as the assets can be sold to cover the margin amount, but this may not be the case in extreme market conditions. The credit card balance is always undercollateralized, because there is nothing to seize in case of nonpayment.

Appendix B: How Much Leverage?

Suppose we deposit stablecoin collateral worth C into Aave, and the maximum loan-to-value ratio for this collateral is r. We then set up a “leverage loop” in which we borrow debt in some other stablecoin, swap back to the collateral token, and redeposit. Ignoring fees and slippage, and assuming both coins hold their intended pegs so there is no risk of liquidation, this is effectively an infinite geometric series. The resulting exposure on the long side is:

C+Cr+Cr2+Cr3+⋯C+Cr+Cr2+Cr3+⋯

We can obtain a position size up to C/(1-r) by looping arbitrarily many times:

∑k=0∞Crk=C1−rk=0∑∞Crk=1−rC

Thus, for initial collateral C, we can get exposure of up to C/(1-r).

Appendix C: Mortgaging a Bored Ape

If we have access to an overcollateralized lender that supports NFT-based collateral, we can also “mortgage” NFTs! Suppose Aave accepts Bored Apes with a maximum collateral ratio set at 70% of the current floor price. Assuming the floor is 100 ETH, we could obtain the floor Ape using a 40% down payment as follows:

- Flash loan 60 ETH to an address holding 40 ETH

- Purchase the floor BAYC for 100 ETH

- Deposit the BAYC in Aave as collateral, with borrowing power of 70 ETH

- Borrow 60 ETH to repay the flash loan, leaving a debt position with a health factor of 70/60 = 1.16

To complete the mortgage analogy, we would gradually deposit ETH until the loan was fully repaid, then withdraw the BAYC. As it happens, this example is not merely hypothetical - NFTfi and BendDAO operate on an Aave-like model and do accept Bored Apes as collateral.

Appendix D: Idleness versus Illiquidity

When we talk about liquidity from a borrower’s perspective, we are referring to funds available for immediate and typically general use. For that reason, it is important to distinguish between two kinds of inactivity: idleness and illiquidity. Overcollateralized lending often reduces idleness by enabling more productive uses for funds that would otherwise sit inactive, but it does so at the price of illiquidity. For instance, if a borrower has a large token holding that would otherwise be sitting in a wallet, lending it out on Aave places that capital back into broader circulation. However, even when idle, those tokens were available to the borrower for general use. Now, some fraction of their value (1-r, to be specific) must remain in Aave to protect overall solvency. Thus, while the borrower has fewer idle assets, they also have less liquid capital to work with for other purposes.